Posts Tagged ‘Kyoto’

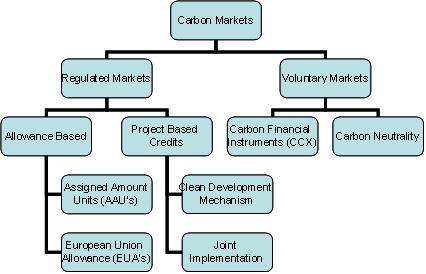

Carbon Markets

This Post is intented to give Overview on International Carbon Markets

Kyoto Protocol (KP) and UNFCCC

• The first major international effort to contain climate change was the United Nations Framework Convention on Climate Change (UNFCCC), an agreement signed by 189 countries in 1992.

• The UNFCCC eventually led to the formation of the Kyoto Protocol in 1997. The Kyoto Protocol, which has been ratified by 164 countries, including the European Union, Japan, Canada, China and India establishes specific targets for emissions reductions for industrialised countries

• Individual countries have agreed to emissions limits, or caps, within the UNFCCC negotiating framework. These caps are currently expressed as a fixed percentage related to the emissions generated by that country in 1990.

• Under Kyoto protocol a total of 39 industrialized countries were given specific limitations in carbon emissions to be met during the 2008-2012 period.

• Developing countries were not given specific targets but are integral to global plans on carbon emissions and are key players in the carbon markets.

• Industrialized and developing countries were referred as ‘Annex 1’ and ‘Annex 2’ countries , respectively

Carbon Credits

• A carbon Credit is the universal unit of measurement used to indicate the global warming potential of greenhouse gases, usually expressed in metric tonnes of carbon dioxide equivalent (mtCO2e)

• Carbon credits create a market for reducing greenhouse emissions by giving a monetary value to the cost of polluting the air. This means that carbon becomes a cost of business and is seen like other inputs such as raw materials or labor.

Carbon Asset Classes

• Carbon Dioxide (CO2)

• Methane (CH4)

• Nitrous oxide (N2O)

• Hydrofluorocarbons (HFCs)

• Perfluorocarbons (PFCs)

• Sulfur hexafluoride (SF6)

The global warming potential of methane is rated as 23, meaning that an emission of one tonne of methane is equal to emissions of 23 tonnes of carbon dioxide in terms of contribution to climate change.

Regulated Markets or ‘Cap-and-trade’ Markets

• A cap and trade system is an emissions trading system, where total emissions are limited or ‘capped’.

• A government or regulatory body sets a limit on the total amount of emissions that are allowed, and issues permits (carbon credits) for that amount. Companies or organisations covered by the cap must only emit according to the permits they possess.

• If companies exceed their allowable limits of emissions, they must obtain credits from other companies that have surplus credits, or by investing in projects that offset their emissions (offset projects).

• Thus, emissions are capped, and emitters can trade credits until their emissions match the amount of permits they possess.

European Union Emissions Trading Scheme (EU-ETS)

• EU-ETS is a trading Scheme within the European Union.

• The tradable unit under the EU-ETS is termed as European Union Allowances (EUA).

• One unit of EUA equals 1 tonne of CO2 equivalent (tCO2e)

• The EU-ETS is an international emission trading system but not a Kyoto Protocol trading system. Compliance units are EU allowances (EUAs), not AAUs (units allocated to countries under Kyoto Protocol known as AAUs).

• The European Union Emissions Trading Scheme (EU ETS) is the world’s largest regulatory cap-and-trade market for the reduction of greenhouse gas emissions.

Clean Development Mechanism (CDM)

• The Clean Development Mechanism (CDM) allows Annex I countries to implement emissions reducing or offsetting projects in non-Annex I countries, and earn Carbon credits that can be applied to meet their own targets.

• The principle behind the CDM is that emissions reductions may be achieved in developing nations in a more cost-effective manner than in industrialised countries

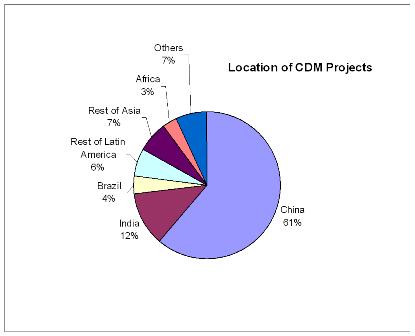

Location of CDM Projects

• Certified Emissions Reductions (CERs) are emissions credits that have been earned under the Clean Development Mechanism.

• CERs can be earned either by making a true emissions cut through the installation of energy efficiency or pollution control equipment, or by offsetting emissions through the creation of a carbon sink.

• The Country has to apply to UNFCCC authorized body for the emissions reductions certification

• CERs also are issued in units of one metric tonne of carbon dioxide equivalent(tCO2e).

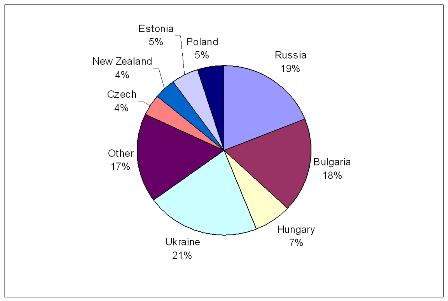

Joint Implementation (JI)

• Joint Implementation (JI) is a mechanism that allows Annex I countries to implement emissions reducing or offsetting projects in another Annex I country and earn Emissions Reduction Units (ERUs) that can be applied to meet their own targets.

• Most JI projects likely will take place in Economies in Transition, such as former Soviet bloc countries, where projects are cost-effective.

Location of JI Projects

• ERUs are issued in units of one metric tonne of carbon dioxide equivalent(mCO2e).

• In both cases, CDM and JI, emissions reductions arising from any project must be verified by a competent national authority before they can be certified and made available for trading, generally known as a national registry. The annual emission reductions and subsequent transactions (transfer of ownership, sale, or permanent retirement) can also be tracked in this registry

Voluntary Carbon Markets

• The voluntary market does not rely on legally mandated reductions to generate demand.

• The market is currently fragmented and has no uniform certification or verification processes or registries.

• Both supply and demand grow significantly slower than a compliance based market which has regulation to drive large-scale demand.

• However, despite these limitations, the voluntary carbon market is evolving extremely fast with many distinct advantages over the compliance market.

• The voluntary market offers significantly lower transaction costs. The costs savings benefit both the supply and demand side.

• Credible international institutions such as PricewaterhouseCoopers, and The Bank of New York are starting to provide services to the voluntary market to help make it more approachable for investors and standardizing the credits being sold.

Carbon Neutrality

• Carbon neutrality refers to zero carbon dioxide emissions released into the atmosphere.

• A key to ensuring genuine and enduring carbon neutrality is the cancellation of the carbon credits that have been purchased to offset the unavoidable emissions.

• Thus, those emissions that cannot be eliminated have to be offset by the purchase of an equivalent amount of carbon credits.

• Companies leading carbon neutrality include HSBC, which became the first carbon neutral bank in 2005.

Market mechanics

• At present, “carbon brokers” connect the supply chain to the buyers. As a result, price information is guarded closely and consequently price transparency does not exist. This creates risks for the participants.

• In addition, there is limited use of registries, which play an important role in ensuring that credits bought for offsetting purposes are cancelled and not on sold to another buyer. This over-the-counter (“OTC”) market also limits knowledge transparency of the transactions (e.g. at what price which instruments were traded) and increases the time it takes to match buyers with sellers.

Leading Exchanges under EU ETS Include

• European Climate Exchange (ECX)

• NordPool

• PowerNext

• European Energy Exchange (EEX)

European Climate Exchange (ECX)

• Located in Amsterdam, ECX is dedicated exchange for trading in Carbon Credits.

• ECX Futures is the most liquid, pan-European platform for carbon emissions trading.

• Its futures contract are based on the underlying EU Allowances (EUAs) attracting over 90% of the exchange-traded volume in the European market.

• All trades on ECX are cleared by LCH.Clearnet regulated by the UK Financial Services Authority

NordPool

• Established in 1993,Nord Pool or The Nordic Power Exchange – is the world’s multinational exchange for trading electric power.

• It started trading in European Union allowances (EUAs) in 2005.

• Nord Pool members can trade through the efficient and user friendly PowerCLICK electronic trading system.

• Nord Pool Clearing (the clearing house) acts as the counterparty in all contracts traded through PowerCLICK

PowerNext

• Powernext is a French exchange, incorporated in 2001 as a subsidiary of the Euronext.

• It has built a network of 90 European members, including energy producers, banks, traders, and retailers for trading electric power .

Exchanges under Voluntary Markets

• Chicago Climate Exchange (CCX) CCX, a self-regulatory exchange, represents a voluntary, legally-binding commitment by North American corporations and other institutions to establish a rules-based market for reducing greenhouse gases.

• It’s fast growing with trading rising from 1mtCO2 in 2005 to 10mt in 2006.

• Carbon credits trades as carbon financial instruments (CFIs) and restricts trading to members who have voluntarily signed up to its mandatory reductions policy.

• CCX operates as a cap-and-trade system in which members agree to cap emissions at a stated level and then trade allowances with other participants if they are either under or over their target.

• Since its launch in late 2003, CCX has grown in membership from 19 institutions to over 131 institutions.

• Members are required to reduce emissions 4% under baseline average emissions of 1990 by 2012.