Archive for February 2008

Excerpts from “Hot Commodities” by Jim Rogers

An interesting book by Jim Rogers “Hot Commodities” offers good understanding of commodities markets. I am highlighting few points from the book that one should be aware of before investing in commodities.

Ø Historically, there is negative correlation between Stocks and Commodity prices. This also explains why Commodity producing companies (e.g. Oil and Mining Companies) and those that support them tend to do well during Commodity bull markets.

Ø Ignoring commodities in a bear stock market may turn quite irrational and fiscally irresponsible.

Ø If looking for fundamental shifts, look for the headlines about the discovery of new oil reserves or wind farms popping up outside major cities, look for new mines coming on line. If you find that stock piles of all the commodities are rising, those are the signs of fundamental shifts.

Ø Commodity prices can rise even when the economy is stuck in reverse. History shows that war and political chaos only put commodity prices higher.

Ø Invest in countries that are rich in Commodities. Currencies will perform better in nations exporting rather than importing commodities. Jim points to Canada, Australia, Brazil and New Zealand for vast deposits of natural resources.

Ø Be wary of internal threats like political Imbalance that may undermine the investment grading of the country despite of huge banks of natural resources. He points out Russia, Venezuela and South Africa where due to internal problems; the countries will find it difficult to exploit the natural resources.

Ø Different Commodity Index’s have different commodities and different weights for those commodities. The Components of these index’s, however are from the same five sectors- Energy, Metals, Grains, Food/Fiber and Livestock.

Ø Dow Jones- AIG Commodity index figures the weighting according to the relative trading activities of an individual commodity averaged with the dollar adjusted for the worldwide production data over five years.

Ø Rogers International Commodity Exchange (RICI) attempts to balance commodities according to their importance in international Commerce.

Ø The best traders in the world are masters of timing. Knowing when to get in and get out, they enter and exit markets fearlessly. But over the decades as an investor, Jim found that the best way for him to make money is to find something cheap that he like, take a position and hold it for long term.

Ø One should be as objective as possible in his research while finding gems in the commodities or Stocks. We all have a tendency to see what we want to see in facts and figures, to make an investment seem hot even if the facts suggest otherwise.

Ø Few Signs of Classis Bull Hysteria– Claims in 2000 that the dot com rally has produced a “new economy” or the one in 1989 that japan is going to dominate the world or that the oil price after 1980 would continue to head into triple figures. And things like this happens in the market, recognize it for what it is, take your profits and look for value elsewhere.

Ø A Yale study concludes that “commodity futures are positively correlated with inflation, unexpected inflation and changes in expected inflation”. This conclusion can be verified with the commodity bull market during 1970’s when double digit inflation was rampant.

Ø Few investors consider commodities and invest in them when it is virtually impossible to make money in stock market.

Ø While investing in commodities companies is one rational way to play in a commodity bull market, it is not necessarily the best way.

While these are few important points, its better to read the book to extract the best out of it.

Excerpts from Reminiscences of a Stock Operator

Jesse Livermore also known as Boy Plunger, was a notable stock trader in early 20th century. “Reminiscences of a Stock Operator” is a book written on his real life experience in stock markets.

Though not a believer in trading, I find few comments in the book quite interesting . I think, traders can relate this book with their trading experience. If you can’t go through the book, its better to go through the following comments.

Ø The desire for constant action irrespective of underlying conditions is responsible for many losses in Wall Street even among the professionals, who feel that they must take home some money every day, as though they were working for regular wages.

Ø There is a right time for everything. And that is precisely what beats so many men in Wall Street. A person who thinks that he must trade all the time is termed as Wall Street Fool. No man can always have adequate reasons for buying or selling stocks daily-or sufficient knowledge to make his play an intelligent play.

Ø Never argue with the tape .Getting sour at the market leads you no where. To be angry at the market because it unexpectedly or even illogically goes against you is like getting angry on your lungs because you have pneumonia.

Ø Of all the speculative blunders there are few greater than trying to average a losing game. Always sell what shows you a loss and keep what shows you a profit.

Ø In advances as well as declines, stock prices were apt to show certain habits, so to speak. There was no end of parallel cases and these made precedents to guide me.

Ø The only guide for a mature trader is the past performance. Whatever has happened in stock market today has happened before and will happen again.

Ø A man must believe in himself and his judgment if he expects to make a living in the game of Stock speculation.That is all that one should learn – to study the general conditions, to take a position and stick to it. A trader should be able to see a setback without being shaken, knowing that it is only temporary.

Ø No body can catch all the fluctuations .In a bull market your game is to buy and hold until you believe that the bull market is near its end. To do this you must study general conditions and not tips or special factors affecting individual stocks. Then wait till you see……the reversal of general conditions.

Ø You can see it all the time. If it is a bull foundation, for instance, certain news items fail to have the effect they would have if the street was bearish. It is all in the state of sentiment at that time. In bull markets bear items are ignored and bull news is exaggerated, and vice versa.

Ø I have often said that to buy in the rising market is the most comfortable way of buying stocks. Now the point is not so much to buy as cheap as possible or go short at the top of the prices, but to buy or sell at the right time. When I am bearish and I sell a stock, each sell must be at a lower level that the previous sale. When I am buying the reverse is true, I must buy on a rising scale.

Ø A man may beat a stock or a group at a certain time, but no man living can beat the stock market! A man may make money out of individual deals in cotton or grain, but no man can beat the cotton or grain market. It’s like the track. A man may beat a horse race, but he cannot beat horse racing.

Ø That is one trouble about trading on a large scale. You cannot sneak out as you can, when you want. You cannot sell out when you think it’s wise. You have to get out when you can; when you have the market that will absorb your entire line.

Ø There is no question advertising is an art and manipulation is an art of advertising through the medium of the tape.

Ø JP Morgan sells an issue of bonds to the public- that is, to investors. A manipulator disposes of a block of stock to the public- that is, speculator. An investor looks for safety, for permanence of the interest return on the capital he invests. The speculator looks for quick profit.

Ø Prices are never too high to begin buying or too low to begin selling.

Ø It is said that there are two sides of every thing. But there is only one side to the stock market; and it is not the bull side or the bear side, but it is the right side

Ø All a man need to do is to appraise prevailing conditions is order to conquer in the market.

Happy Trading!

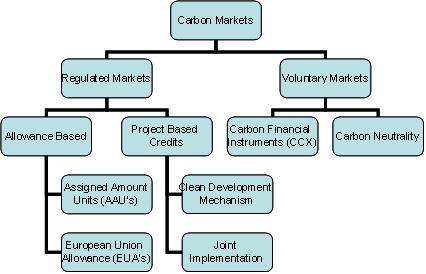

Carbon Markets

This Post is intented to give Overview on International Carbon Markets

Kyoto Protocol (KP) and UNFCCC

• The first major international effort to contain climate change was the United Nations Framework Convention on Climate Change (UNFCCC), an agreement signed by 189 countries in 1992.

• The UNFCCC eventually led to the formation of the Kyoto Protocol in 1997. The Kyoto Protocol, which has been ratified by 164 countries, including the European Union, Japan, Canada, China and India establishes specific targets for emissions reductions for industrialised countries

• Individual countries have agreed to emissions limits, or caps, within the UNFCCC negotiating framework. These caps are currently expressed as a fixed percentage related to the emissions generated by that country in 1990.

• Under Kyoto protocol a total of 39 industrialized countries were given specific limitations in carbon emissions to be met during the 2008-2012 period.

• Developing countries were not given specific targets but are integral to global plans on carbon emissions and are key players in the carbon markets.

• Industrialized and developing countries were referred as ‘Annex 1’ and ‘Annex 2’ countries , respectively

Carbon Credits

• A carbon Credit is the universal unit of measurement used to indicate the global warming potential of greenhouse gases, usually expressed in metric tonnes of carbon dioxide equivalent (mtCO2e)

• Carbon credits create a market for reducing greenhouse emissions by giving a monetary value to the cost of polluting the air. This means that carbon becomes a cost of business and is seen like other inputs such as raw materials or labor.

Carbon Asset Classes

• Carbon Dioxide (CO2)

• Methane (CH4)

• Nitrous oxide (N2O)

• Hydrofluorocarbons (HFCs)

• Perfluorocarbons (PFCs)

• Sulfur hexafluoride (SF6)

The global warming potential of methane is rated as 23, meaning that an emission of one tonne of methane is equal to emissions of 23 tonnes of carbon dioxide in terms of contribution to climate change.

Regulated Markets or ‘Cap-and-trade’ Markets

• A cap and trade system is an emissions trading system, where total emissions are limited or ‘capped’.

• A government or regulatory body sets a limit on the total amount of emissions that are allowed, and issues permits (carbon credits) for that amount. Companies or organisations covered by the cap must only emit according to the permits they possess.

• If companies exceed their allowable limits of emissions, they must obtain credits from other companies that have surplus credits, or by investing in projects that offset their emissions (offset projects).

• Thus, emissions are capped, and emitters can trade credits until their emissions match the amount of permits they possess.

European Union Emissions Trading Scheme (EU-ETS)

• EU-ETS is a trading Scheme within the European Union.

• The tradable unit under the EU-ETS is termed as European Union Allowances (EUA).

• One unit of EUA equals 1 tonne of CO2 equivalent (tCO2e)

• The EU-ETS is an international emission trading system but not a Kyoto Protocol trading system. Compliance units are EU allowances (EUAs), not AAUs (units allocated to countries under Kyoto Protocol known as AAUs).

• The European Union Emissions Trading Scheme (EU ETS) is the world’s largest regulatory cap-and-trade market for the reduction of greenhouse gas emissions.

Clean Development Mechanism (CDM)

• The Clean Development Mechanism (CDM) allows Annex I countries to implement emissions reducing or offsetting projects in non-Annex I countries, and earn Carbon credits that can be applied to meet their own targets.

• The principle behind the CDM is that emissions reductions may be achieved in developing nations in a more cost-effective manner than in industrialised countries

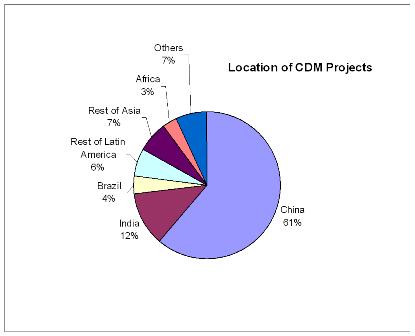

Location of CDM Projects

• Certified Emissions Reductions (CERs) are emissions credits that have been earned under the Clean Development Mechanism.

• CERs can be earned either by making a true emissions cut through the installation of energy efficiency or pollution control equipment, or by offsetting emissions through the creation of a carbon sink.

• The Country has to apply to UNFCCC authorized body for the emissions reductions certification

• CERs also are issued in units of one metric tonne of carbon dioxide equivalent(tCO2e).

Joint Implementation (JI)

• Joint Implementation (JI) is a mechanism that allows Annex I countries to implement emissions reducing or offsetting projects in another Annex I country and earn Emissions Reduction Units (ERUs) that can be applied to meet their own targets.

• Most JI projects likely will take place in Economies in Transition, such as former Soviet bloc countries, where projects are cost-effective.

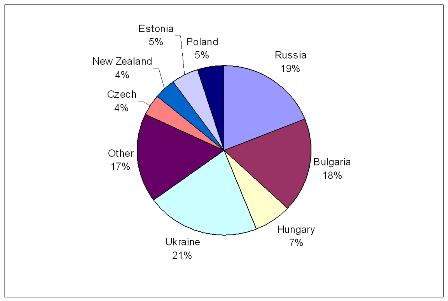

Location of JI Projects

• ERUs are issued in units of one metric tonne of carbon dioxide equivalent(mCO2e).

• In both cases, CDM and JI, emissions reductions arising from any project must be verified by a competent national authority before they can be certified and made available for trading, generally known as a national registry. The annual emission reductions and subsequent transactions (transfer of ownership, sale, or permanent retirement) can also be tracked in this registry

Voluntary Carbon Markets

• The voluntary market does not rely on legally mandated reductions to generate demand.

• The market is currently fragmented and has no uniform certification or verification processes or registries.

• Both supply and demand grow significantly slower than a compliance based market which has regulation to drive large-scale demand.

• However, despite these limitations, the voluntary carbon market is evolving extremely fast with many distinct advantages over the compliance market.

• The voluntary market offers significantly lower transaction costs. The costs savings benefit both the supply and demand side.

• Credible international institutions such as PricewaterhouseCoopers, and The Bank of New York are starting to provide services to the voluntary market to help make it more approachable for investors and standardizing the credits being sold.

Carbon Neutrality

• Carbon neutrality refers to zero carbon dioxide emissions released into the atmosphere.

• A key to ensuring genuine and enduring carbon neutrality is the cancellation of the carbon credits that have been purchased to offset the unavoidable emissions.

• Thus, those emissions that cannot be eliminated have to be offset by the purchase of an equivalent amount of carbon credits.

• Companies leading carbon neutrality include HSBC, which became the first carbon neutral bank in 2005.

Market mechanics

• At present, “carbon brokers” connect the supply chain to the buyers. As a result, price information is guarded closely and consequently price transparency does not exist. This creates risks for the participants.

• In addition, there is limited use of registries, which play an important role in ensuring that credits bought for offsetting purposes are cancelled and not on sold to another buyer. This over-the-counter (“OTC”) market also limits knowledge transparency of the transactions (e.g. at what price which instruments were traded) and increases the time it takes to match buyers with sellers.

Leading Exchanges under EU ETS Include

• European Climate Exchange (ECX)

• NordPool

• PowerNext

• European Energy Exchange (EEX)

European Climate Exchange (ECX)

• Located in Amsterdam, ECX is dedicated exchange for trading in Carbon Credits.

• ECX Futures is the most liquid, pan-European platform for carbon emissions trading.

• Its futures contract are based on the underlying EU Allowances (EUAs) attracting over 90% of the exchange-traded volume in the European market.

• All trades on ECX are cleared by LCH.Clearnet regulated by the UK Financial Services Authority

NordPool

• Established in 1993,Nord Pool or The Nordic Power Exchange – is the world’s multinational exchange for trading electric power.

• It started trading in European Union allowances (EUAs) in 2005.

• Nord Pool members can trade through the efficient and user friendly PowerCLICK electronic trading system.

• Nord Pool Clearing (the clearing house) acts as the counterparty in all contracts traded through PowerCLICK

PowerNext

• Powernext is a French exchange, incorporated in 2001 as a subsidiary of the Euronext.

• It has built a network of 90 European members, including energy producers, banks, traders, and retailers for trading electric power .

Exchanges under Voluntary Markets

• Chicago Climate Exchange (CCX) CCX, a self-regulatory exchange, represents a voluntary, legally-binding commitment by North American corporations and other institutions to establish a rules-based market for reducing greenhouse gases.

• It’s fast growing with trading rising from 1mtCO2 in 2005 to 10mt in 2006.

• Carbon credits trades as carbon financial instruments (CFIs) and restricts trading to members who have voluntarily signed up to its mandatory reductions policy.

• CCX operates as a cap-and-trade system in which members agree to cap emissions at a stated level and then trade allowances with other participants if they are either under or over their target.

• Since its launch in late 2003, CCX has grown in membership from 19 institutions to over 131 institutions.

• Members are required to reduce emissions 4% under baseline average emissions of 1990 by 2012.